Can You Buy a Home in Albuquerque if You are Unemployed?

Are you unemployed and thinking about buying a home in Albuquerque? You might think it's an impossible feat. But it might be possible to still qualify for a mortgage if you have other forms of income.

In short, you can't use your unemployment benefits to get a mortgage, but there may be other options to help you buy a home in Albuquerque.

What Forms of Income Count?

There are numerous types of income you can use if you are trying to get a mortgage. If you have dividends from investments or Social Security income, these can be included as income for mortgage purposes.

Another option is to have a co-signer.

Mortgage lenders do not consider unemployment income because it's a short-term source of income. Therefore, it isn't qualified income. Getting a mortgage while you are unemployed requires that at least one of the applicants has financial documentation.

In most cases, lenders require a stable income for at least two years. Lenders must also prove that income will continue for at least three years into the future. A lender cannot verify your future earnings if you're recently unemployed.

What Happens If You Return to Work?

Once you return to work after being on unemployment, you may not have to show a two-year job history to a lender. Depending on certain factors, reapplying for a mortgage might not even be necessary.

The factors can include, for example, whether or not you have income from other sources, how you handled your finances while unemployed, or the size of your down payment.

In the event that you have not yet started your new job, but you have an offer letter for employment, you may be able to qualify for a mortgage. The letter may need to verify that you'll be employed within 90 days of getting the mortgage, and it should also show your income.

Applying with a Co-Signer

A co-borrower will make it easier for you to get a mortgage following an unemployment period. When making an assessment, a lender will consider the income, debt-to-income ratio, and credit score of the other borrower.

Your co-borrower will need to have a good credit rating and a steady, verifiable income.

What is Considered Income?

Regular income payments made to you are counted by most lenders when determining whether you qualify for a mortgage.

This can include, for instance, income from a traditional job as well as many types of government benefits, self-employment, child support, and alimony. You can include income from rental properties if you own them. Payments you receive as a freelancer also count.

Lenders consider retirement and disability benefits to be income. Dividends, capital gains, and interest income can sometimes be considered.

Among the things that do not count as income are income that's not listed on tax returns, illegal income and projected income. If a lender is unable to verify your income, it won't be accepted, and capital withdrawals can't be used.

As a whole, you cannot use unemployment income to get a mortgage, but there are other options, such as finding a co-signer or co-borrower, or using other forms of income.

HOT ALBUQUERQUE PROPERTY OF THE WEEK!

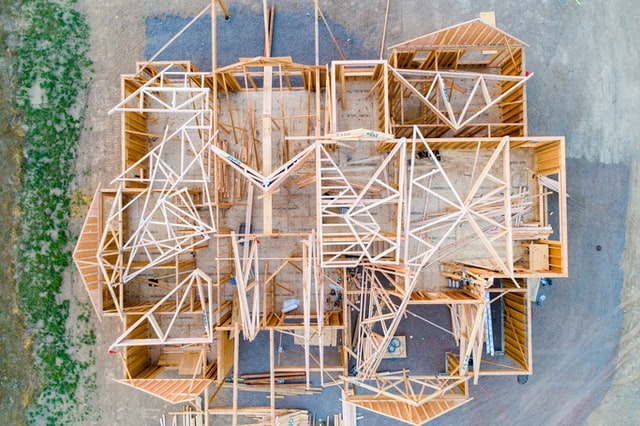

4501 ATHERTON Way NW, Albuquerque, NM 87120

Exquisite custom Tuscan home-in the gated community of Oxbow North. Impeccable hand crafted cabinetry throughout, travertine tile with inlay, gourmet kitchen with Wolf Appliances and Sub-Zero Refrigerator. Commercial grade radiant heating system (plus central forced air).Two master suites, 3 custom fireplaces, tiled balcony with breathtaking views of the city and mountains. Surround sound in great room and loft area, 4 car tandem garage..and so much more. Enjoy your next memorable home.

Contact us today to help you buy or sell your next home in Albuquerque. Looking for the perfect home for sale in Albuquerque? Our easy-to-use home search tool can help you start the process. Join us twice a week on our blog for more real estate advice and great reasons to buy a home in Albuquerque and the surrounding area. Follow us on Facebook for the latest Albuquerque real estate updates.

Get your Morning Inspiration with the Sandi Pressley Team